Get clarity in minutes with our free mortgage tools

Whether you’re buying your first home, remortgaging, investing in buy-to-let, or moving up the ladder, our mortgage calculators help you make informed decisions – fast.

Use them to estimate:

- How much you could borrow

- What your monthly repayments might be

- How much Stamp Duty you’ll pay

- Rental yield on investment properties

- Your Loan-to-Value (LTV)

These tools give a quick estimate. For tailored advice based on your circumstances, speak to our team of CeMAP-qualified mortgage advisers.

Your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.

A leading UK Mortgage broker since 2005 – Trusted by over 10,000 people every year

See your best mortgage options with our free online mortgage calculator

With DirectQuote, our industry leading mortgage calculator makes it easy for you to tailor and compare the latest mortgage deals available to you.

![]()

Unsure which mortgage option is right for you?

If you’re unsure which mortgage option is right for you – call today to speak with one of our mortgage experts or talk with us via our live mortgage advisor help chat.

Useful mortgage calculators

Mortgage Affordability Calculator

Find out how much you could borrow based on your income and outgoings.

Mortgage Repayment Calculator

See what your monthly payments could be based on interest rate and term.

Stamp Duty Calculator

Calculate exactly how much Stamp Duty you’ll owe – including first-time buyer and second home rates.

Buy-to-Let Rental Yield Calculator

Work out gross rental yield on a property to assess its investment potential.

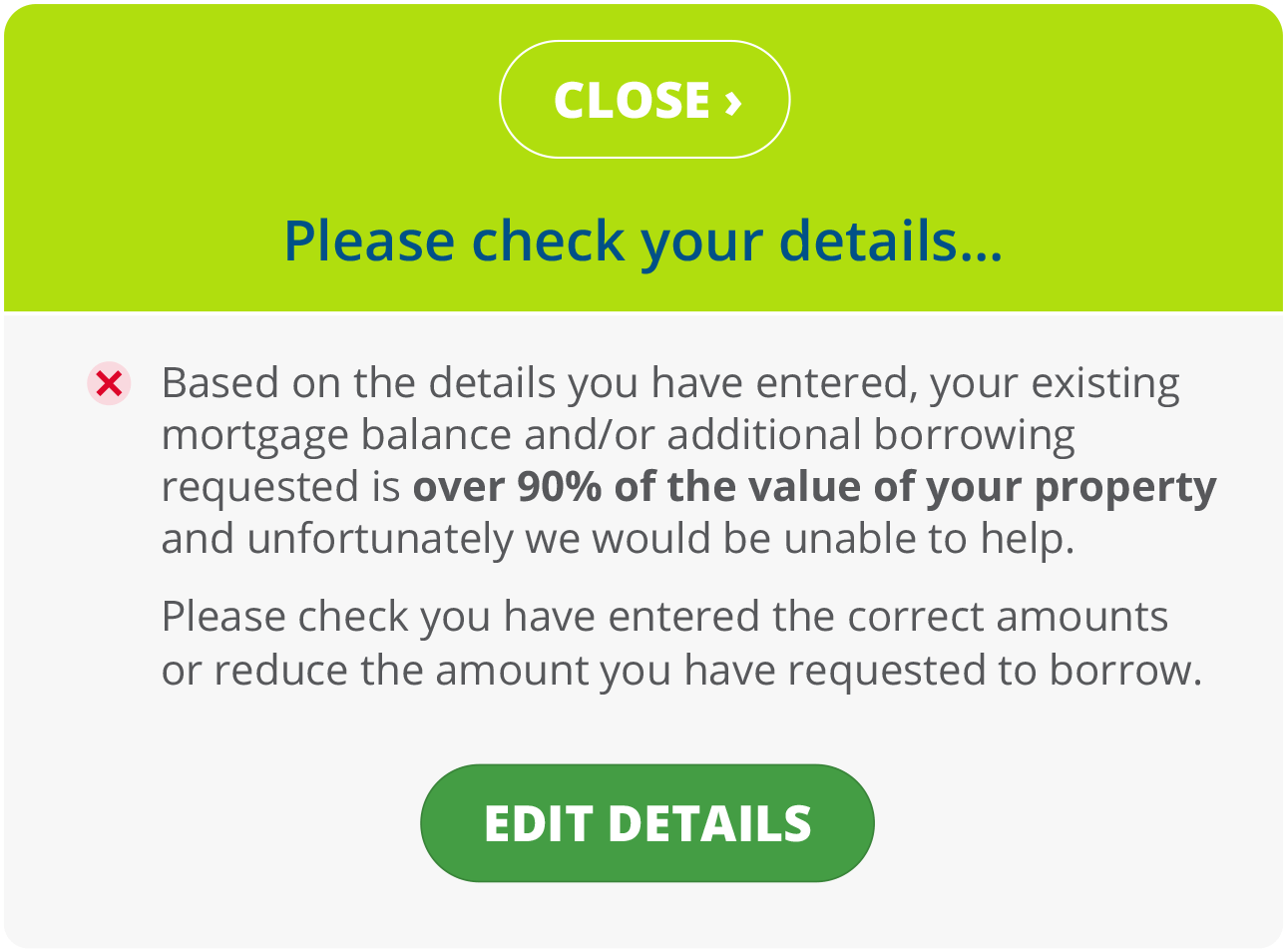

Loan-to-Value (LTV) Calculator

See accurate mortgage deals based on your LTV calculation – fast and simply.

![]()

Instantly see how much you could save by remortgaging with our simple and accurate mortgage calculator

Even a small drop in your interest rate can result in thousands of pounds saved over the life of your mortgage.

Example: If you’re on a £200,000 mortgage at 6.5% and you switch to 5.2%, you could save over £150 per month.

Why use our calculators – and not just any online tool?

Here’s some key reasons that really make the difference…

- Built with the UK mortgage market in mind

- Updated with the latest 2025 lending criteria and tax rules

- Backed by a real advisory team, not just a faceless tool

- No spam, no hard sell – just useful insights

Need help understanding your results?

That’s what we’re here for. While calculators are a great first step, they don’t consider:

- Complex income (e.g. self-employed, bonuses, contractors)

- Credit history or existing debts

- Your goals (e.g. raise capital, buy-to-let expansion, early repayment plans)

- Specialist lender criteria

That’s where we come in.

Why thousands trust us with their mortgage advice

- Established in 2005 with nearly two decades of experience

- Every adviser is CeMAP qualified and FCA-authorised

- We’ve helped thousands of clients find the right mortgage – backed by verified reviews across Google, Trustpilot, Review Centre, and Reviews.io

- We compare the whole market, including exclusive deals you won’t find online

Our advice is free, impartial, and tailored to your situation.

Want an expert to run the numbers with you?

Let our experienced team give you a detailed, personalised mortgage assessment – no cost, no obligation.