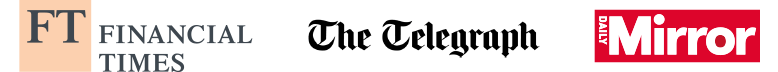

Compare the UKs best secured loan deals in minutes and see how low the monthly repayments could be

See how much you could borrow and tailor your perfect secured loan option without affecting your credit score.

- Find your best secured loan deal

- Save loan quote – return any time

- Quote won’t affect credit score

- Easily complete whole process online

- Compare lowest rates & repayments

Your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.

A leading UK loan broker since 2005 – Trusted by 1,000s of people every year

See your best Secured Loan options online in minutes…

With DirectQuote, our industry leading, secure online process makes it easy for you to tailor and compare the latest secured loan deals available to you from all the leading UK lenders.

![]()

Unsure which secured loan option is right for you?

If you’re unsure which secured loan option is right for you – call today to speak with one of our loan experts or talk with us via our live advisor help chat.

Types of secured loan

Homeowner Loans

Debt Consolidation Loans

Bad Credit Secured Loans

Home Improvement Loans

What can you use a Secured Loans for?

Home improvements

Extensions, renovations, new kitchens, and property upgrades

Debt consolidation

Combine multiple debts into one manageable monthly payment

Business investment

Fund business expansion, equipment, or working capital

Major purchases

Cars, boats, caravans, or other significant expenditures

Education costs

University fees, training courses, or professional development

Investment opportunities

Property purchases, portfolio investments, or ventures

![]()

How much could you save by consolidating expensive credit with a secured loan?

With the average credit card interest rate at around 24.39%, it’s easy to see how consolidating with a low rate secured loan could reduce many customers credit repayments by £100s each month.

Many customers reduce their monthly repayments by over £500 each month…

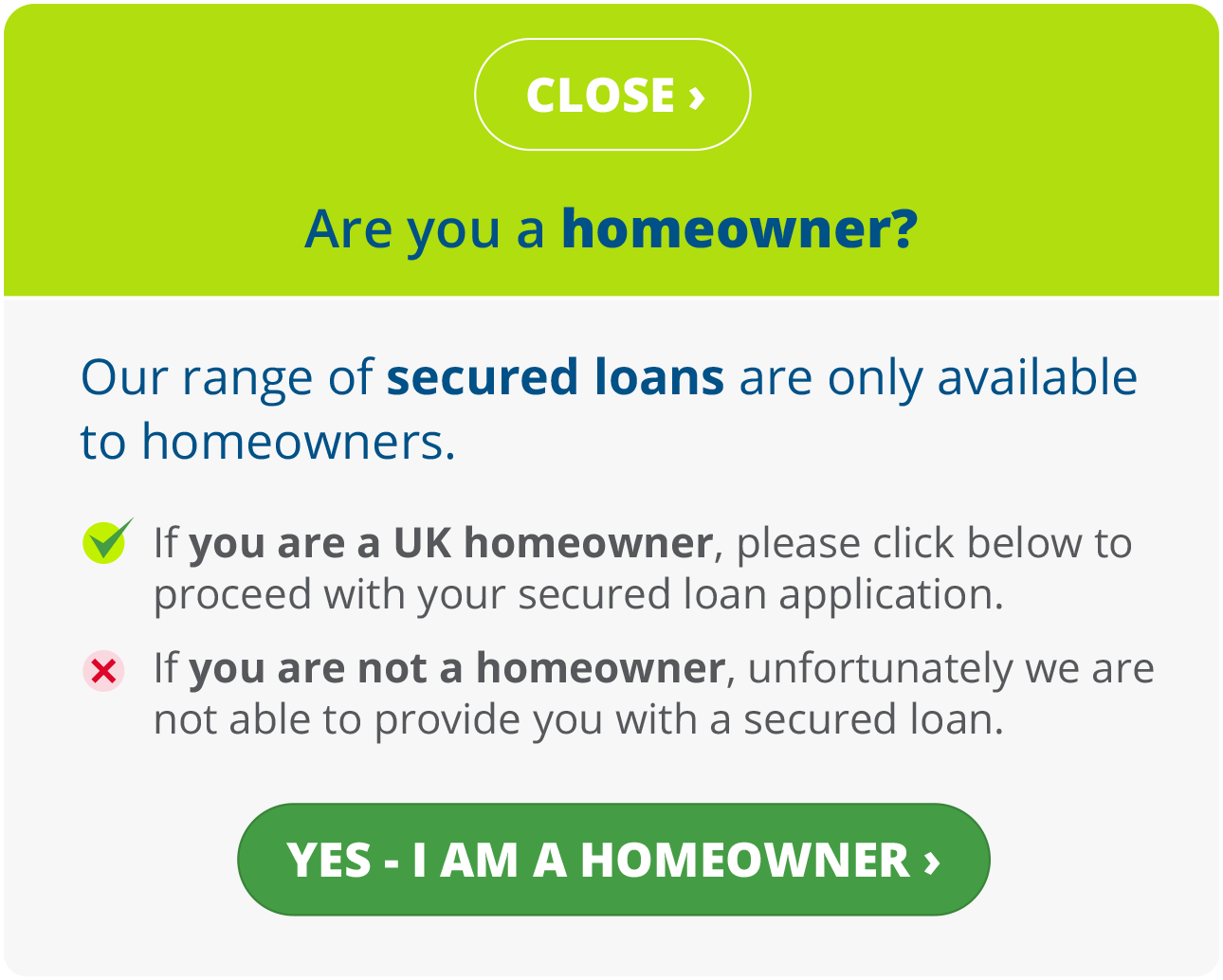

How do Secured Loans work?

1

Use your property as security

Your home or other property acts as collateral for the loan.

2

Apply for the amount you need

Borrow from £10,000 up to £2.5 million based on property equity.

3

Undergo property valuation

Lender assesses your property value to determine loan amount.

4

Complete affordability checks

Income and expenditure review to ensure repayment capability.

5

Receive funds

Once approved, funds are released typically within 4-6 weeks.

Should you choose a Secured Loan?

Secured loans are ideal if:

- You need to borrow a large amount (£25,000+)

- You want longer repayment terms to reduce monthly payments

- You have less-than-perfect credit but own property

- You want lower interest rates than unsecured alternatives

Consider alternatives if:

- You only need a small amount (under £15,000)

- You don’t want to put your property at risk

- You can get competitive unsecured rates

- You might want to move house soon

Secured vs Unsecured Loans Comparison Feature

See how a secured loan compares to an unsecured loan and which better meets your needs.

| Secured Loans | Unsecured Loans | |

| Borrowing amounts | £10,000-£2.5m | £1,000-£50,000 |

| Interest rates | Lower (3.9%-15%) | Higher (5%-35%+) |

| Loan terms | 3-30 years | 1-7 years |

| Credit requirements | More flexible | Stricter requirements |

| Security required | Property needed | No security required |

| Risk to property | Loan secured against property | No property risk |

Tools & Support

Secured loan product information

- Borrow from £10,000 to £2.5 million (subject to equity)

- Loan term over 3 to 30 years

- Interest rates from 3.9% to 15% APR

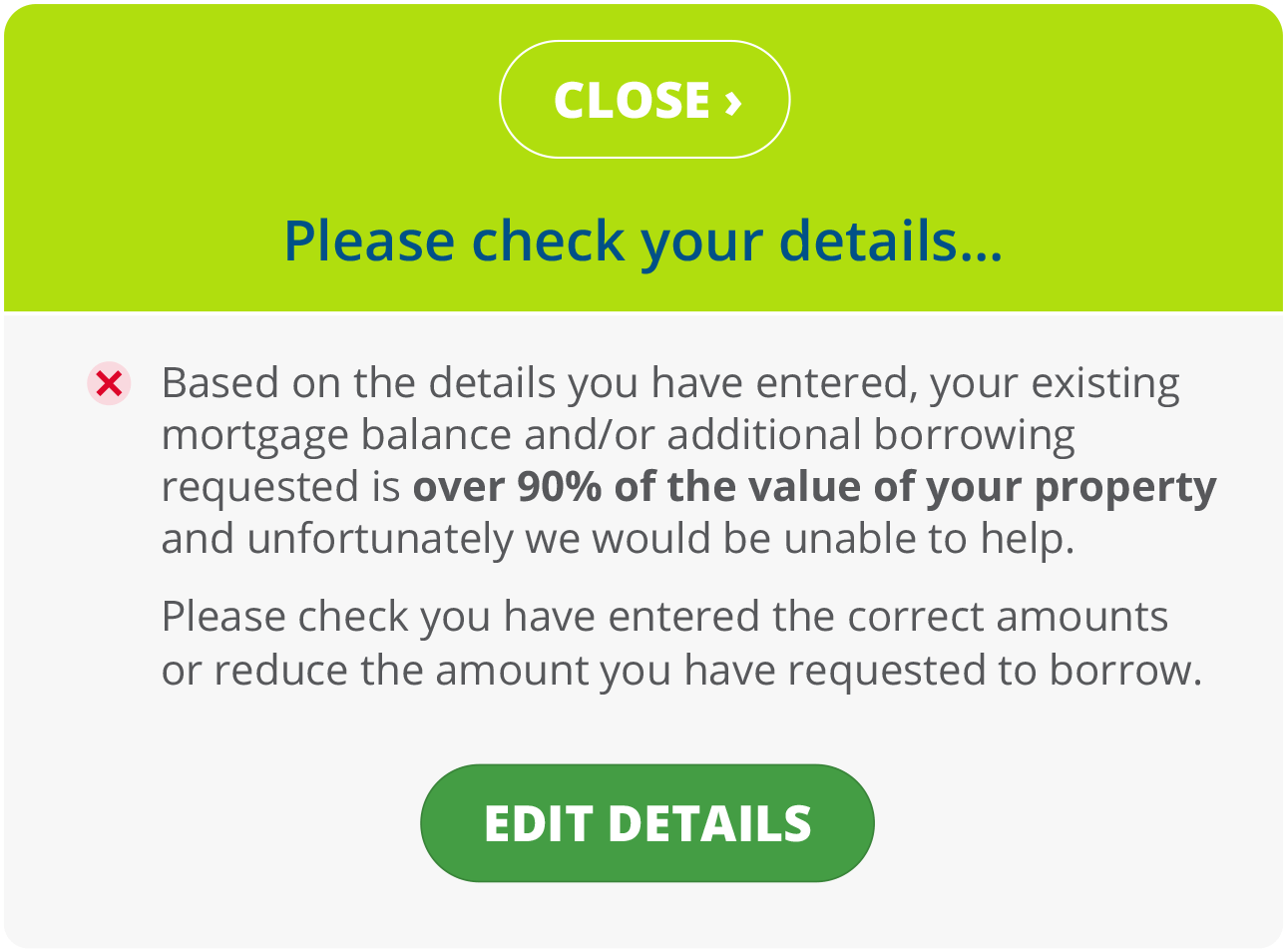

- LTV up to 85% of property value

- Early repayment usually allowed with potential charges

Frequently Asked Questions about Remortgages

Your lender could repossess your property to recover the debt, so ensure payments are affordable.

Yes, secured loans are often available to those with poor credit, though rates may be higher.

Typically at least 15-20% equity, with most lenders requiring you to retain some equity after the loan.

Usually yes, but check for early repayment charges that could make this expensive.

Key takeaways

- Secured loans offer access to larger amounts at lower rates than unsecured credit

- Your property is at risk if you cannot maintain repayments

- Compare total costs including fees, not just interest rates

- Ensure you have a clear plan for using and repaying the funds

Ready to Explore Secured Loan Options?

Get expert advice on secured loans today – speak to a specialist about your borrowing needs.