See the best First Time Buyer mortgage deals to get you on the mortgage ladder

We’ll show you how much you could borrow, and what the rate and monthly repayments could be without affecting your credit score, so you can make confident financial decisions on finding your first property.

We’ve made the process quick, simple and secure.

- Compare rates from all leading lenders

- Formal lender offer within 24hrs

- Save mortgage quote – return any time

- Quote won’t affect credit score

- Easily complete whole process online

Your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.

A leading UK Mortgage broker since 2005 – Trusted by over 10,000 people every year

See your best First Time Buyer mortgage options online in minutes…

With DirectQuote, our industry leading, secure online process makes it easy for you to compare and tailor your first mortgage with confidence.

![]()

Searching for your first mortgage and unsure which options are right for you?

As a First Time Buyer, we understand purchasing your first property is a big deal – but securing a mortgage doesn’t have to be complicated or stressful. Our experts are always on hand ready to talk through any questions you may have – at every step of the way.

Simply call today to speak with one of our mortgage experts or talk with us via our live mortgage advisor help chat.

First-Time Buyer Mortgage Guide – How to Get on the Property Ladder

Find out how much you could borrow

See how much you could borrow and what your repayments could be with our mortgage calculator.

Try our mortgage calculator.

See the latest mortgage rates in minutes

Compare the latest mortgage deals to see what your interest rate and monthly repayments could be.

Compare remortgage rates online now

What is a First-Time Buyer Mortgage?

A first-time buyer mortgage is designed for people purchasing their first home.

You don’t need to sell an existing property, but you do need to meet lender criteria for income, credit, and deposit.

Getting your first mortgage can feel overwhelming – but with the right support, it’s easier than you think.

Who counts as a First-Time Buyer?

You’re usually considered a first-time buyer if:

- You’ve never owned a property before (in the UK or abroad)

- You’re buying your main residence (not a buy-to-let)

- You’re not named on anyone else’s property or mortgage

Tip: If you’re buying with someone who has owned property before, you may not qualify for first-time buyer benefits like Stamp Duty relief.

How much can you borrow as a First-Time Buyer?

This depends on:

- Your income (employed, self-employed, or joint)

- Existing debts (credit cards, loans, etc.)

- Monthly outgoings (bills, childcare, etc.)

- Your credit score

Typical borrowing: Lenders offer around 4 to 4.5x your annual income, but this varies based on your circumstances.

What deposit do you need to buy your first home?

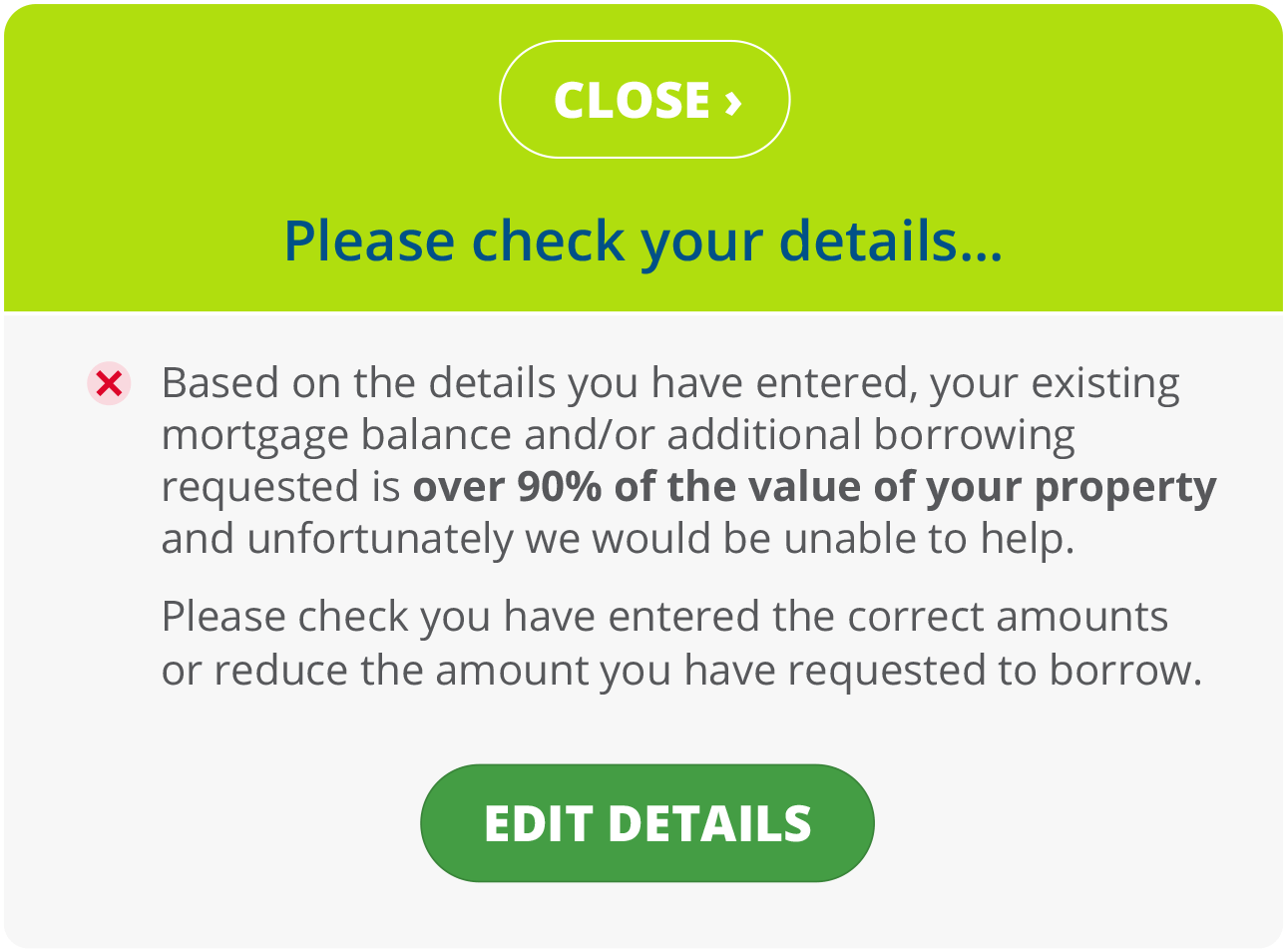

- Minimum deposit: 5% of the property value

- Better rates available if you have 10–20% or more

- Gifted deposits from family are often accepted (with a letter)

Example: For a £250,000 home, a 5% deposit would be £12,500

What do you need to apply for a mortgage?

- Proof of ID and address

- 3–6 months’ bank statements

- Payslips or tax returns (if self-employed)

- Credit history check

- Deposit proof (savings, gift, or ISA)

Step-by-step guide to getting your first mortgage

1

Check your credit report and improve your score if needed

2

Speak to a broker to understand your options

3

Get a Decision in Principle (DIP)

4

Start house hunting with confidence

5

Make an offer & apply for a mortgage

6

Complete property valuation and underwriting

7

Exchange contracts and move in!

Types of Mortgages for First-Time Buyers

You can speak with one of our team at any time for advise on the right options for you based on your financial circumstances.

| Mortgage Type | Description | Notes |

| Fixed-rate | Locked interest rate (2–10 years) | Most popular for budgeting |

| Tracker | Follows Bank of England base rate | Monthly payment can change |

| Variable | Interest rate may change at lender’s discretion | Can go up or down |

| Offset | Uses your savings to reduce mortgage interest) | Great for high savers |

| Help to Buy | (Phased out in England) | Still available in some areas |

| Shared Ownership | Buy part of a home, rent the rest | Lower deposit required |

| First Homes scheme | Discounted new-build properties | Must meet eligibility criteria |

Costs to Budget for as a First-Time Buyer

Keep in mind all the financial considerations beyond just the mortgage:

| Cost Type | Typical Range |

| Mortgage arrangement fee | £0–£1,000 (sometimes waived) |

| Survey/valuation fee | £400–£800+ |

| Solicitor fees | £850–£1,500 |

| Stamp Duty | £0 if under £425,000 (as a first-time buyer) |

| Broker fee | Varies — often waived or refunded |

| Moving costs | £500–£2,000+ depending on location |

Why Use a Mortgage Broker as a First-Time Buyer?

- Help you understand how much you can borrow

- Access exclusive deals you won’t find online

- Save time by handling lender paperwork

- Offer honest advice about schemes and options

- Reduce stress in a process that can feel overwhelming

Frequently Asked Questions by First Time Buyers

Yes – some lenders specialise in lower-income applications. A broker can help you find the right match.

Yes – and you’ll get a 25% government bonus on savings up to £4,000 per year.

You don’t need a perfect score – but a clean credit history improves your chances and rate options.

Possibly – specialist lenders exist, but you may need a higher deposit or pay a higher rate.

You’ll need at least 1–2 years of accounts or SA302s — and ideally a consistent income pattern.

Key takeaways for First-Time Buyers

- You can get started with a 5% deposit, but a higher one gives you better rates

- Understand your borrowing power before you start house hunting

- Be prepared for extra costs like legal fees and surveys

- Working with a broker can save you time, money, and stress

Ready to Buy Your First Home? Let’s Make It Happen

Get a free consultation with a friendly mortgage specialist – no jargon, no pressure.