Find the best mortgage deals for moving home with our leading online mortgage comparison

Easily compare the latest mortgage rates from all the leading lenders to find the best deal for your next home move.

See how much each lender could offer you in just minutes and tailor your perfect option without affecting your credit score.

We’ve made the process quick, simple and secure.

- Compare rates across whole of market

- Formal lender offer within 24hrs

- Save mortgage quote – return any time

- Quote won’t affect credit score

- Easily complete whole process online

Your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.

A leading UK Mortgage broker since 2005 – Trusted by over 10,000 people every year

See your best mortgage options for your new home move online in minutes…

With DirectQuote, our industry leading, secure online process makes it easy for you to compare and tailor a moving home mortgage deals.

![]()

Moving home and unsure which mortgage option is right for you?

If you’re unsure which mortgage option is right for you when looking to move to a new property – simply call today to speak with one of our mortgage experts or talk with us via our live mortgage advisor help chat.

Moving home mortgage guides – everything you need to know

Find out how much you could borrow

Looking to move? See how much you could borrow and what your repayments could be with our mortgage calculator.

Try our mortgage calculator.

See the latest mortgage rates in minutes

Compare the latest mortgage deals to see what your interest rate and monthly repayments could be.

Compare remortgage rates online now

What is a Moving Home Mortgage?

If you’re selling your current property and buying a new one, you’ll likely need a moving home mortgage.

This could mean:

- Porting your existing mortgage to a new property, or

- Getting a new mortgage deal entirely

The right option depends on your circumstances, lender, and how much you need to borrow.

Should you port your existing mortgage or start fresh?

Most mortgages today are portable, meaning you can transfer the same deal to your new home. However, it’s not always the best option.

Porting

- Avoid early repayment charges

- Must reapply & may not be approved

New deal

- Potentially lower rate, more flexibility

- Could involve fees or ERCs

Important: Even if you’re porting, you still need to go through the full affordability and credit checks.

How to get the best mortgage when moving

- Start early – begin planning 3-6 months in advance

- Check your credit report – and fix any errors

- Get an up-to-date property valuation

- Use a broker to compare deals (including top-up options)

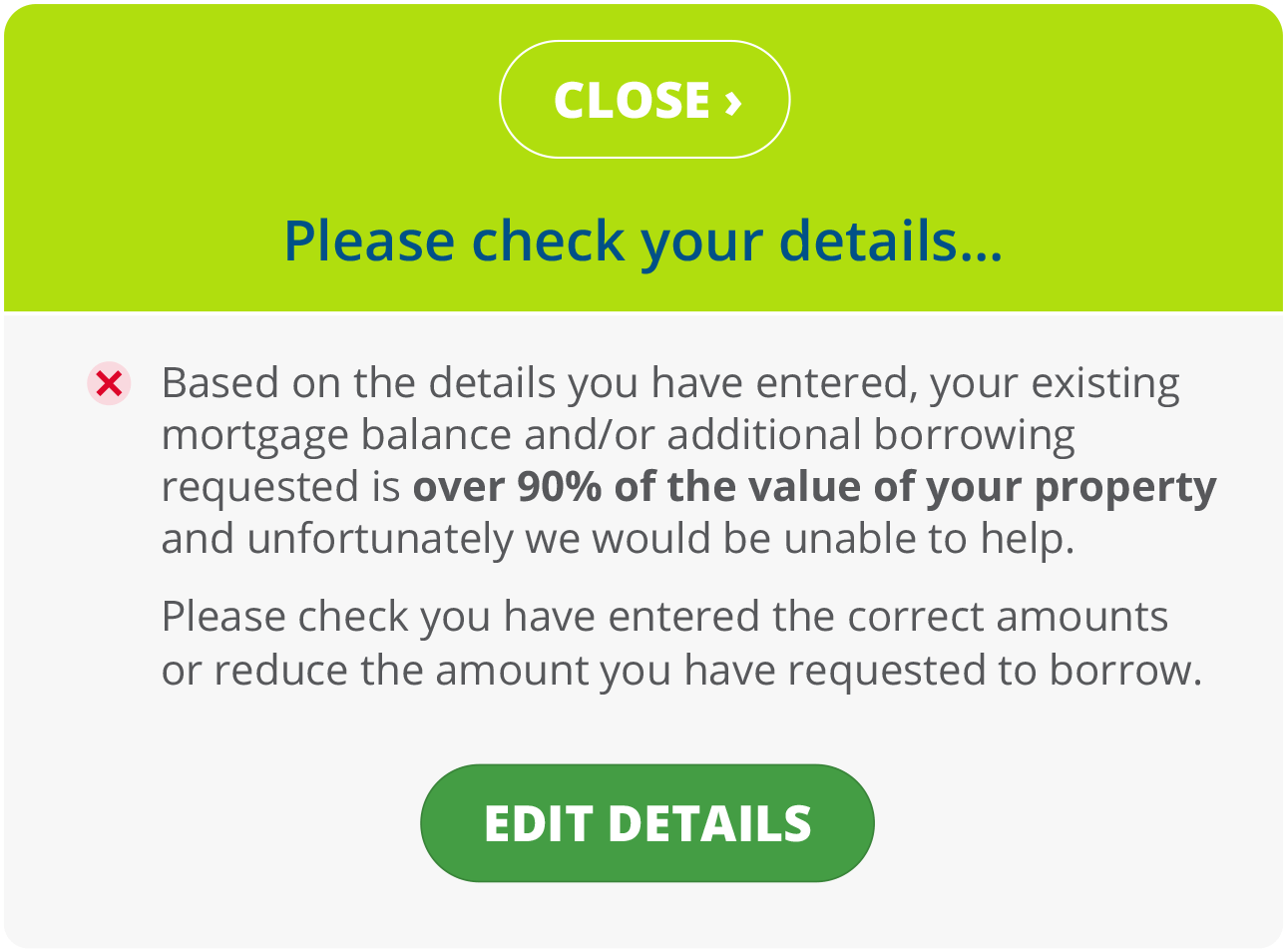

How much can you borrow when moving home?

Your borrowing power is based on:

- Income and outgoings

- Existing equity

- The value of your new property

- Credit profile

You may be able to increase your loan (called a “top-up”), but it could come with a different rate.

Moving home mortgage process – step-by-step

1

Speak to a broker or lender for advice on your options

2

Get a Decision in Principle (DIP)

3

List your current home for sale

4

Find a new property and make an offer

5

Submit your full mortgage application

6

Lender valuation & underwriting

7

Exchange contracts & complete

Tip: Coordinating buying and selling at the same time can be complex – having a mortgage adviser can help align timelines.

What are the costs of moving home?

Moving comes with several financial considerations beyond just the mortgage:

| Cost Type | Typical Range |

| Estate agent fees | 1%–3% of sale price |

| Stamp Duty (on new home) | Based on property value – check thresholds |

| Legal/conveyancing fees | £850–£1,500+ |

| Mortgage fees | Arrangement, valuation, legal – varies by lender |

| Early repayment charges | If not porting or exiting early |

Why Work With a Mortgage Broker When Moving?

Moving home often involves more variables than a first-time purchase.

A broker can:

- Compare porting vs. new mortgage options

- Help manage timelines for sale & purchase)

- Access exclusive deals not available direct

- Save you time and stress in a high-pressure move

Frequently Asked Questions about Remortgages

Yes, but you may need a separate loan segment, especially if porting your existing deal.

You may need a bridging loan or consider letting out your existing home temporarily (let-to-buy).

Possibly – check for early repayment charges (ERCs) in your current agreement.

Not always – equity from your current property can act as your deposit for the next one.

Key takeaways

- You can port your mortgage or apply for a new one — both options have pros and cons

- Start early, especially if your purchase and sale are linked

- Costs include legal fees, Stamp Duty, and potentially ERCs

- A mortgage broker can help you find the best deal and streamline the process

Ready to move? Get expert mortgage advice today

Let our FCA-regulated mortgage advisers help you compare options, understand costs, and move with confidence.